Should you buy the dip? Dollar-cost Averaging Explained

Should you buy the dip? After doing your own analysis and market research, the choice is yours!

You've probably come across the terms "buy the dip", "buy low, sell high". But what does it really mean when someone tells you to do this? And how does dollar-cost averaging play a part?

How do you buy the dip?

Buying the dip is a trading strategy used by thousands of people all across the world to trade crypto and other currencies. It's a basic investment strategy that can be phrased as “buy the dips.” This doesn’t mean go all in while an asset’s price is going down, it means average in as it goes down and/or buy after it settles.

Further, this strategy is reportedly much safer to use in a bull market or a stagnant market, where the general trend is up or sideways (as opposed to a bear market where the general trend is down).

With that said, to buy the dips one might do one or more of the following:

- Buy incrementally as the price goes down - This means you're creating an average position and aiming to buy more as the price decreases further.

- Wait until the price settles, and perhaps even shows signs of recovering, and buy at that point (buy a reaction off of support).

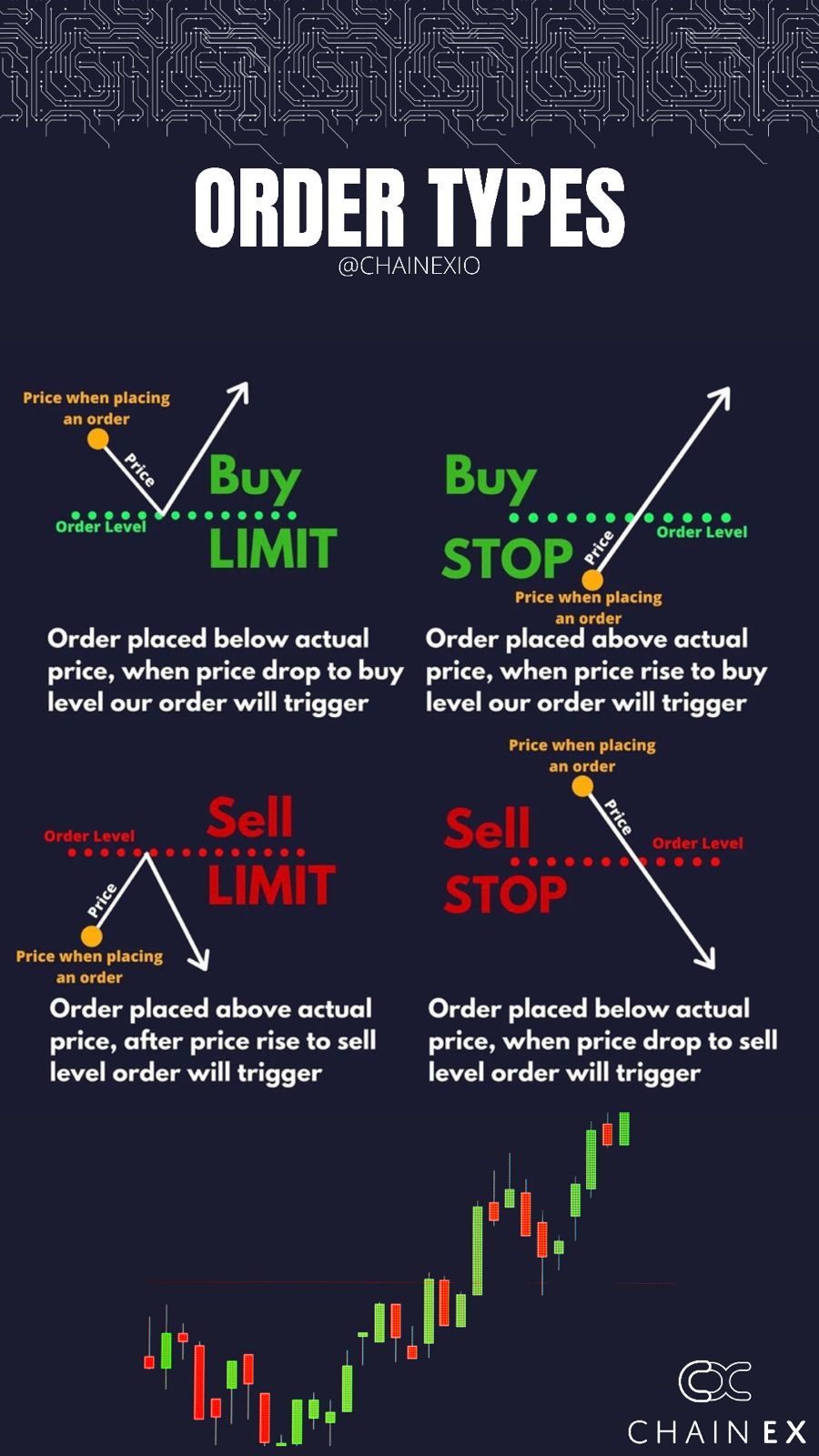

- Set buy orders at lower prices and let them fill. Setting buys just before historic support levels, large “buy walls,” and psychological levels is an especially good strategy (as prices tend to do at least a quick bounce off these levels).

How do you identify where to buy the dip?

Well, buying at support is a great place to start. The biggest question is where is support and where do you apply the strategy?

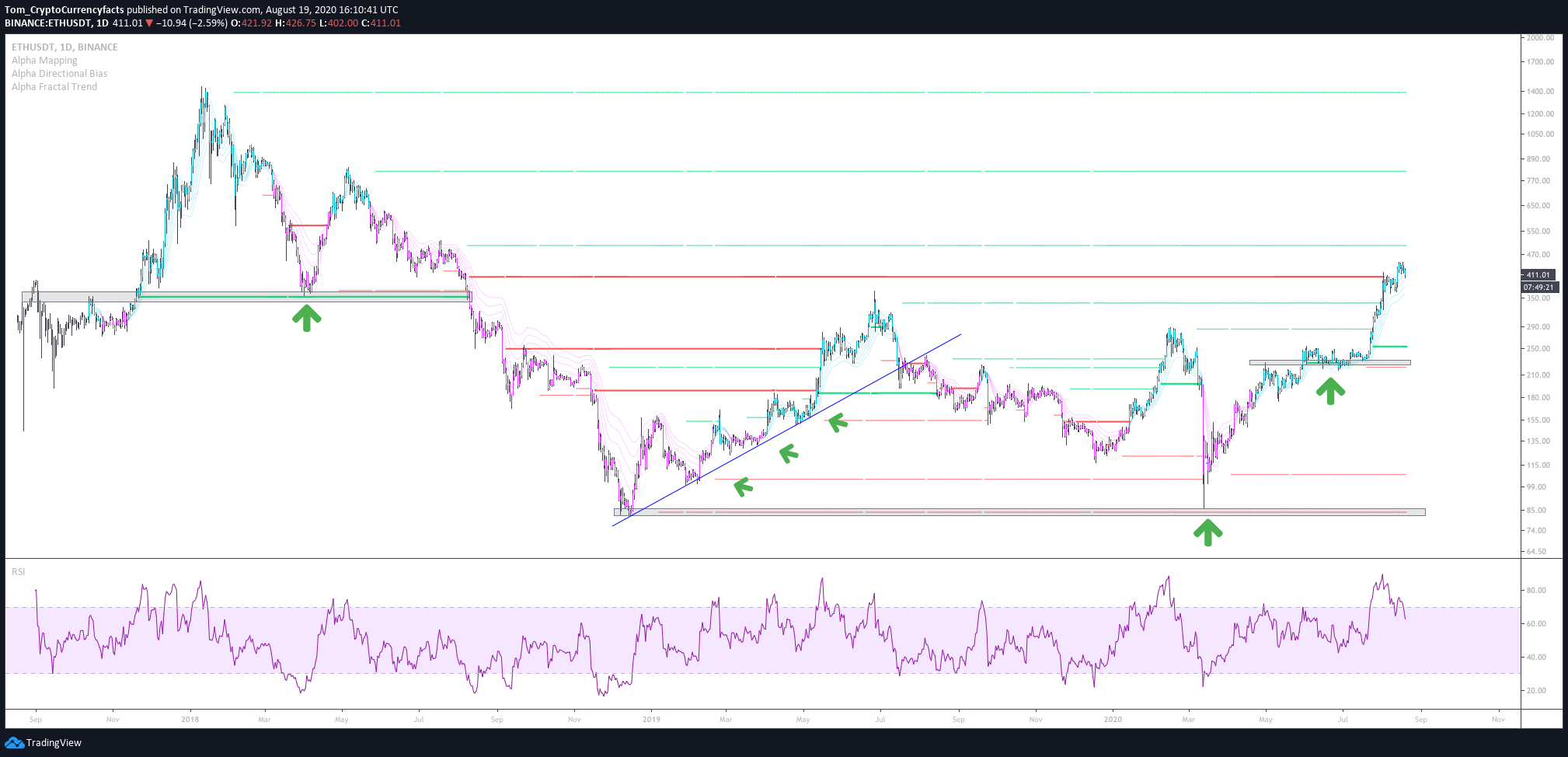

The chart below is an example of support levels. In this case, these are horizontal levels where price has previously consolidated and approached trendlines that price is reacting to.

These are logical places to buy the pullback (AKA “the dip”). Front-running clear support levels with a stop below the level is often more effective than just blindly buying every dip.

Among all the aspects of technical analysis, perhaps one of the most important and actionable concepts are support and resistance. Many other aspects of technical analysis, such as price patterns, are based on the key concepts of support and resistance.

Support represents a low level a price reaches over time, while resistance represents a high level a price reaches over time. Make sense? This is a topic we will touch on in the future.

Advanced Dollar Cost Averaging

As mentioned in our previous blog, Dollar-cost averaging (DCA) is a strategy where you as an investor invest a total sum of money in small increments over time instead of all at once. The goal is to take advantage of market downturns without risking too much capital at any given time.

If based on your analysis, you are convinced that the next bull market is here, and you have money waiting patiently on the sidelines, then the goal is to convert the fiat into BTC as safely as possible. The goal is not necessarily to get the very best price, instead the objective should be to maintain a cost basis that is lower than the spot price. Dollar Cost Averaging into a bull market is a very simple and effective way to make that happen.

If it is a bull market then the price will be consistently appreciating and after enough time consistent purchases are expected to result in an average cost basis than is lower than the current spot price.

The other way to Dollar Cost Average is by price. For example if an individual has X to invest then that person can enter 10% every time that the price appreciates 10%. This is a more aggressive approach and is done to ensure that a certain amount of exposure is achieved at a certain price point.

When Dollar Cost Averaging by price it is possible to go months, or years, without making an entry. Conversely it would also be feasible to make multiple entries during the same month if the volatility warrants it.

So should you buy the dip?

With that all noted, and as you can see on the chart above, one can “buy the big dips” (or buy when the price has gone well below the average), or one can “buy the little dips” (or buy when the price comes down from wherever it last was).

One can “buy the dips” to sell quickly for a profit, to build a long term position, or to incrementally take gains. In all cases, the concept is the same, aiming to buy at a lower price when price consolidates or corrects.

Ready to start trading?

There's another way to earn with ChainEX!

Invite a friend to ChainEX and earn more rewards! Plus you’ll be partnering with what could potentially be the best cryptocurrency exchange in South Africa. I mean,