FSCA Crypto Regulation Update in South Africa

On 19 October the FSCA updated their position on cryptocurrency regulation in South Africa. According to the update, cryptocurrency will now be treated as a financial product in South Africa and those offering it will have to play by stricter rules. The FSCA has published the declaration of crypto assets as a financial product under the FAIS Act, which was gazetted on the 19th of October 2022.

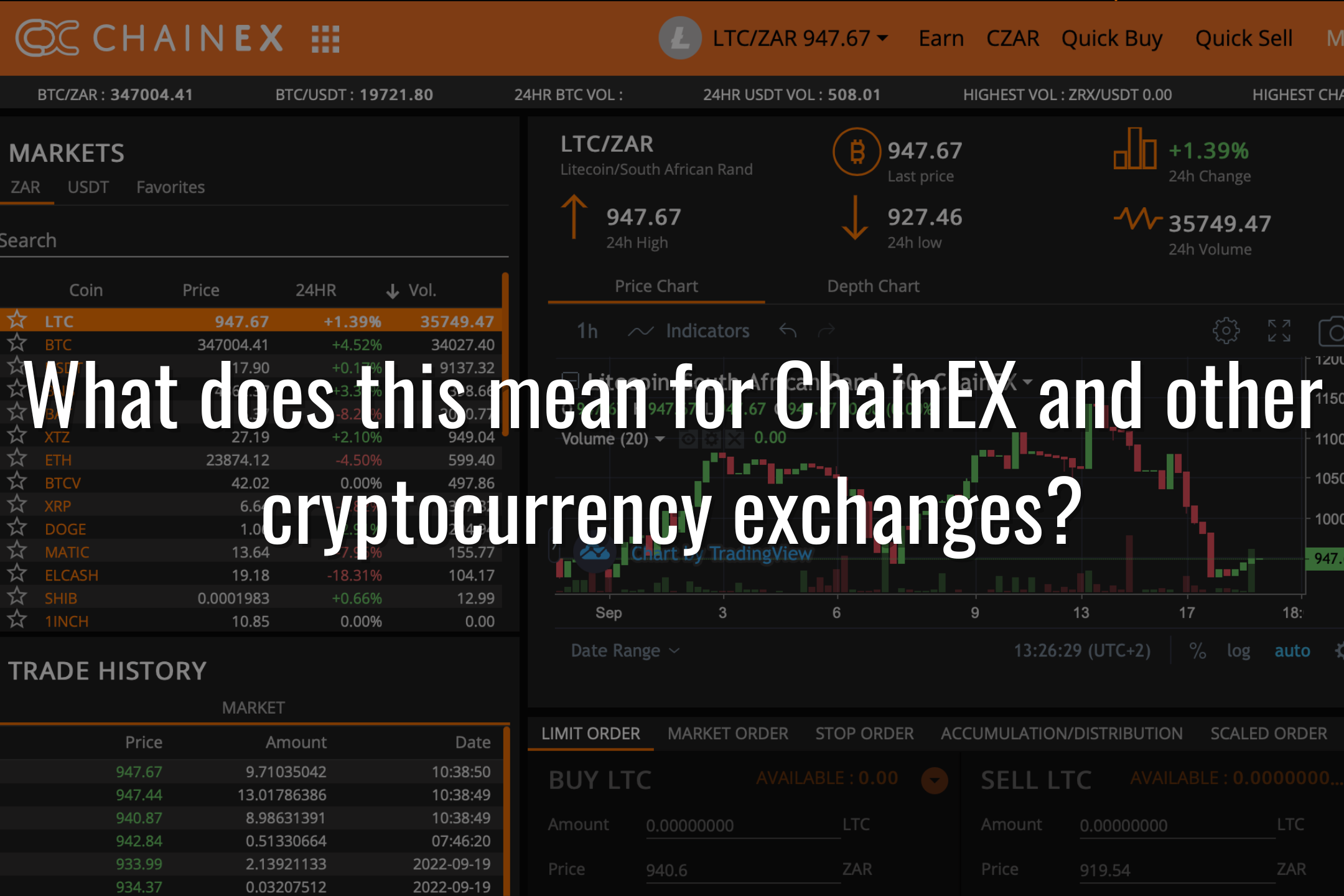

What does this mean for ChainEX and other cryptocurrency exchanges? In the short term, not a lot, but in the long term it means cryptocurrency exchanges will have to apply to be registered Financial Service Providers. This will change operations not only for ChainEX but for all CASP’s (Crypto Asset Service Providers) operating within the South African Jurisdiction. To operate legitimately in the future, all exchanges or “CASP’s” would need to obtain a license to operate and service customers within South Africa.

This does not come as a surprise as South Africa was well aware that this was in the pipeline as the FSCA published a draft Declaration of crypto assets as a financial product under the FAIS Act, on 20 November 2020. Most role players in South Africa have been preparing for this outcome and ChainEX will be ready to apply for their licenses when the applications open.

When will these regulations start?

They have already started in a way, as cryptocurrency will now officially be treated as a financial product. This has an effect on quite a few things namely; advising, reporting, compliance and offering. The latter being the biggest change, as offering cryptocurrency in South Africa will now require the party offering the financial product to be a registered FSP. The exchanges in South Africa will have to apply for FSP licenses with applications opening on the 1st of June in 2023, until then, exchanges are free to operate as normal.

Some have said that this period of time is too short for these exchanges to put in place the necessary processes and mechanisms, but feedback from the industry has been somewhat positive as most of the exchanges have already implemented systems and processes that large financial institutions use to operate. This is due to exchanges in South Africa needing to be compliant with the FIC Act which was required by third party service providers. Being FIC Act compliant means that there has to be adequate systems in place to comply with suspicious activity reporting, proper KYC onboarding and AML (Anti Money Laundering) measures. These measures have been put in place by most major exchanges like ChainEX and it will form the foundation on which the exchanges build anything else required to get their FSP licenses.

How will this impact traditional financial institutions?

It is believed that crypto is going to filter into every aspect of people’s lives just like the internet did. It is hard to recall a time when we used faxes to send messages and had to go to the library for information, however this was not that long ago and in the same way soon your fridge will order your milk for you using the internet, crypto will engrain itself in every aspect of our lives. As one gains a greater understanding of crypto and the potential that lies within, it is inevitable that financial institutions will move into the space. Regulations not only protect consumers but at the same time legitimise that which it regulates.

Regulation further opens the doors for financial players to gain legitimate exposure to crypto and expand services to their massive client base. In fact, we are already seeing some big financial institutions advertising crypto and crypto related positions and one does not advertise roles for a sector you are not moving into, so it was inevitable.

This opens doors for traditional institutions to start offering crypto and crypto related products, it will eventually lead to these institutions also being able to advise clients on these products and ultimately lead to large corporations adding cryptocurrency into their traditional product offerings such as can be seen in the United States in companies such as the Fidelity investment group.

Will we see acquisitions and mergers?

Crypto has been on the radar of big financial institutions for a long time. This regulation now opens the doors for the banking and financial institutions to become players in the game. Many of the banks have already been building their systems to cater for crypto services and if this is the case, then the need to buy up a smaller exchange is not necessary. However, we are all aware of the importance of being first to market and the huge advantage that gives you over your competitors. So, with that being said, a robust and tested system, which most of the large exchanges have, that is compliant and built by crypto and blockchain experts will most definitely be desirable to these institutions.

The existing crypto players do not only have knowledge and understanding of the space but were also able to build a unique system from the ground up and had the luxury of being able to resolve system bugs as they came up along the way. Like with any business some things can only be learnt and uncovered when operating and as most of the existing exchanges have been operating for a few years, in a space that is only 12 years old, time has been on their side.

To build a brand-new system and foresee all the potential pitfalls before you start operating in a space is near impossible for anyone and any organisation, it will always take time and time is a resource that is in short supply when trying to be first to market or at the very least getting to market within a reasonable time after your competitors. It would not be surprising if we see some mergers or acquisitions taking place in the time until license applications open.

Are these regulations good or bad for the everyday investor?

We often hear it being said in the crypto space that the value of crypto, specifically the altcoins, is derived from its utility. If regulation enables utility in the crypto space, then that is a positive outcome and with increased utility there should be further adoption by everyday South Africans, which in turn leads to a higher level of crypto education and in the long term could potentially lead to a positive impact on the price of crypto.

Regulation in countries like South Africa where almost 5 million people have already invested in crypto in some shape or form will hopefully lead to the expansion of services and products since there is a definite demand for it. This should bring about larger players entering the market and adding crypto to their existing business models, which increases the demand for crypto. The prices of cryptocurrencies are very much linked to demand and should therefore impact the price positively in the long term as more people become comfortable with buying crypto, large firms start offering crypto related services and scams struggling to get off the ground due to the strict regulations in place.

If you are looking for a reputable exchange that has been around for a while, look no further than ChainEX, who has been operating since the start of 2018 and has thousands of satisfied clients. ChainEX offers the lowest fees, the most tradeable coins, a negative maker fee of up to 15% and gives 16% of the trading fees away to you when you refer someone to ChainEX. There are countless more reasons to use ChainEX as your preferred crypto exchange, it is as easy as downloading their App on the App store or Google play store to get started.